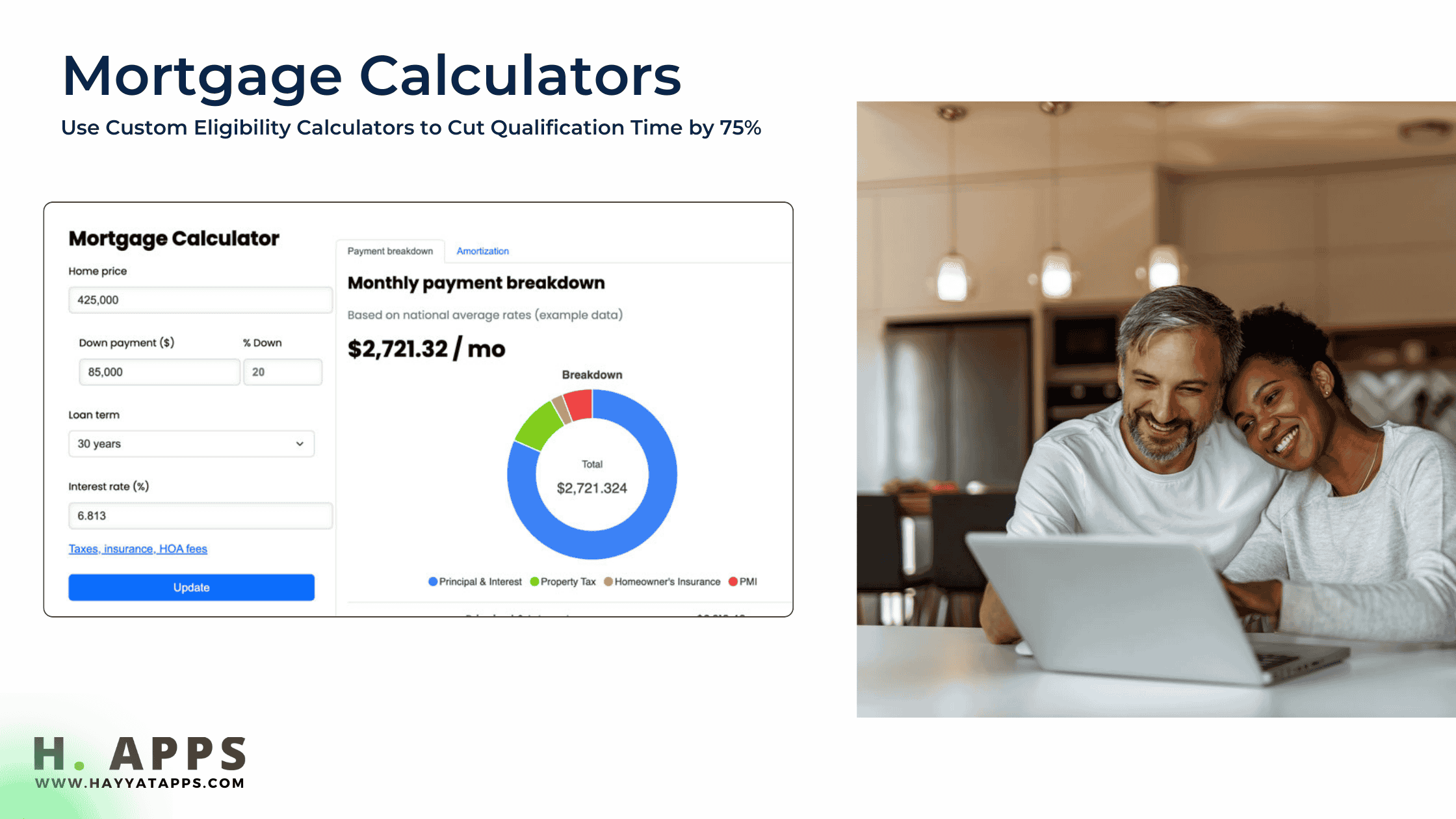

How Modern Mortgage Brokers Use Custom Eligibility Calculators to Cut Qualification Time by 75%

In today’s fast-moving real estate and lending environment, borrowers expect instant answers, fast pre-qualification, and transparent eligibility criteria. Mortgage brokers who still rely on manual calculations, long email exchanges, and outdated PDF forms often lose clients to faster competitors.

The solution? Modern brokers are now using Custom Mortgage Eligibility Calculators—intelligent, automated tools that assess borrower qualification in seconds. These calculators reduce qualification time by as much as 75%, helping brokers close more deals and streamline their workflow.

Whether you operate as an independent broker or run a full lending office, an automated eligibility calculator can transform your sales funnel, reduce manual work, and instantly filter out unqualified leads before they ever reach you.

1. Why Mortgage Brokers Need Instant Qualification Tools

Borrowers no longer want to wait hours or days to find out if they qualify for a mortgage. The faster you deliver results, the more likely the client will move forward with you.

A modern eligibility calculator offers several advantages:

- Instant pre-qualification results

- Accurate DTI & LTV calculations

- Automatic lead scoring

- Fewer manual errors in underwriting

- Faster follow-ups and higher conversion rates

This speed is exactly why brokers embracing automation consistently outperform those using traditional workflows.

2. How Mortgage Brokers Use Calculators Without Any Technical Skills

Many brokers assume that tools like eligibility calculators require coding, IT setup, or CRM integration. But today, calculators can be delivered as a simple mobile-friendly shareable link, requiring zero tech knowledge.

You don’t need a website, hosting, or software training. When a borrower enters their income, credit range, debts, and loan details, the calculator instantly processes results—and the broker receives all lead information by email or SMS.

This means any broker—whether tech-savvy or not—can modernize their pipeline and qualify borrowers instantly.

3. What Exactly Is a Mortgage Eligibility Calculator?

A mortgage eligibility calculator is an automated online tool that analyzes a borrower’s financial profile and determines whether they qualify for a loan program such as:

- Conventional loans

- FHA loans

- VA loans

- USDA loans

- Jumbo loans

It typically collects:

- Gross monthly income

- Credit score range

- Monthly debts

- Loan amount & down payment

- Property location & type

Using custom underwriting rules, the calculator instantly shows whether the borrower is likely eligible—and what they should adjust if not.

4. Why Borrowers Prefer Instant Eligibility Tools

Today’s borrowers prefer fast, self-service tools. They don’t want to fill long PDF forms or wait for a loan officer to “review and get back to them.”

Eligibility calculators appeal to borrowers because they offer:

- Immediate qualification insights

- Zero sales pressure

- Mobile accessibility

- Personalized results

- Clear financial expectations before applying

This transparency significantly increases borrower trust and reduces friction in the lending process.

5. How Mortgage Brokers Use Calculators to Capture High-Intent Leads

Custom eligibility calculators act as automated lead funnels. Every time a borrower uses the tool, their information is sent directly to the broker.

This enables brokers to:

- Prioritize highly qualified borrowers

- Reduce time wasted on unqualified leads

- Respond faster with accurate guidance

- Offer personalized loan recommendations

- Increase conversions through speed and clarity

Adding a calculator to your website, landing page, Google Business Profile, or ad campaigns can dramatically increase the number of ready-to-apply borrowers.

6. Features That Make Eligibility Calculators Powerful Lead Tools

Custom calculators come with advanced features designed to help mortgage brokers automate and scale their workflow:

- Lead Capture Forms: Collect borrower contact details before showing results.

- Automatic DTI & LTV Calculations: Eliminate manual math errors.

- Loan Type Recommendations: FHA, VA, USDA, Conventional—based on borrower profile.

- Branded PDF Pre-Qualification Reports: Borrowers receive instant professional summaries.

- CRM Integrations: Sync leads to HubSpot, Salesforce, or a custom CRM.

- Email/SMS Notifications: Brokers get instant alerts when a lead uses the calculator.

With these features, brokers spend less time doing administrative work and more time closing loans.

7. Real-World Examples: How Brokers Cut Qualification Time by 75%

Here are real-use cases of how brokers transform their workflow using custom calculators:

- Independent Mortgage Broker: Reduced qualification time from 2 hours to 20 minutes using automated DTI/LTV scoring.

- Small Lending Office: Increased weekly qualified leads by 60% through automated pre-qualification.

- Boutique Loan Agency: Improved client satisfaction by delivering instant affordability insights.

- Real Estate Teams: Use calculators to pre-screen buyers before connecting them to preferred lenders.

The result is consistent: faster approvals, smarter lead filtering, and more closed loans.

8. Benefits of Eligibility Calculators for Borrowers

Borrowers enjoy several key advantages:

- Instant understanding of qualification likelihood

- Greater confidence in beginning the mortgage process

- Clear expectations about monthly payments and ratios

- Fewer surprises during underwriting

- More transparent communication with brokers

Borrowers feel empowered, which leads to higher satisfaction and faster follow-through.

9. Custom Calculators vs Generic Mortgage Tools

While online calculators exist, most are generic and cannot match the broker’s underwriting rules or capture leads effectively.

| Feature | Generic Online Calculator | Custom Eligibility Calculator |

|---|---|---|

| Accurate underwriting logic | No | Yes |

| Lead capture & scoring | No | Strong |

| Instant eligibility insights | Limited | Fully automated |

| Branding & customization | None | Full branding |

| CRM Integration | No | Yes |

10. Where Mortgage Brokers Place Their Eligibility Calculators

To maximize visibility and usage, brokers often add calculators to:

- Website homepage

- Loan program pages (FHA, VA, Conventional, etc.)

- Landing pages for Google Ads or Facebook Ads

- Email campaigns or SMS follow-ups

- Google Business Profile website link

- QR codes on flyers or business cards

- Real estate partner referral funnels

This placement ensures borrowers get immediate answers, increasing conversions.

11. Helpful External Resources

12. Internal Reference

To explore how a custom mortgage eligibility calculator can be built for your business, visit:

Convert Your Mortgage Formula into a Lead-Generating Web App

13. Final Thoughts

Custom mortgage eligibility calculators are no longer optional—they are essential tools for brokers who want to close loans faster, pre-qualify leads automatically, and stand out in a competitive market.

By offering instant results, transparent calculations, and automated lead capture, brokers can dramatically increase their efficiency and conversion rates. Whether you're a solo mortgage professional or a growing lending firm, integrating a custom eligibility calculator will help you stay ahead of the competition.

Khyzar Hayat

Founder - Hayyat Apps

Build a Custom Mortgage Eligibility Calculator That Pre-Qualifies Borrowers Instantly

Turn your mortgage underwriting rules into a fast, mobile-friendly eligibility calculator that delivers instant pre-qualification results. Automate DTI/LTV calculations, capture high-intent borrower leads, and reduce your manual qualification time by up to 75%—all without any technical skills required.

Your custom mortgage calculator can be ready within 7 days, with pricing starting at $99.

Build Your Mortgage Eligibility Calculator